Where to Mail Form 4868 and How to Complete It Online

U.S. taxpayers use the IRS Form 4868 to request an automatic extension of time to file their individual income tax return. While the form does not extend the time to pay any taxes owed, it grants an additional six months to submit the completed return.

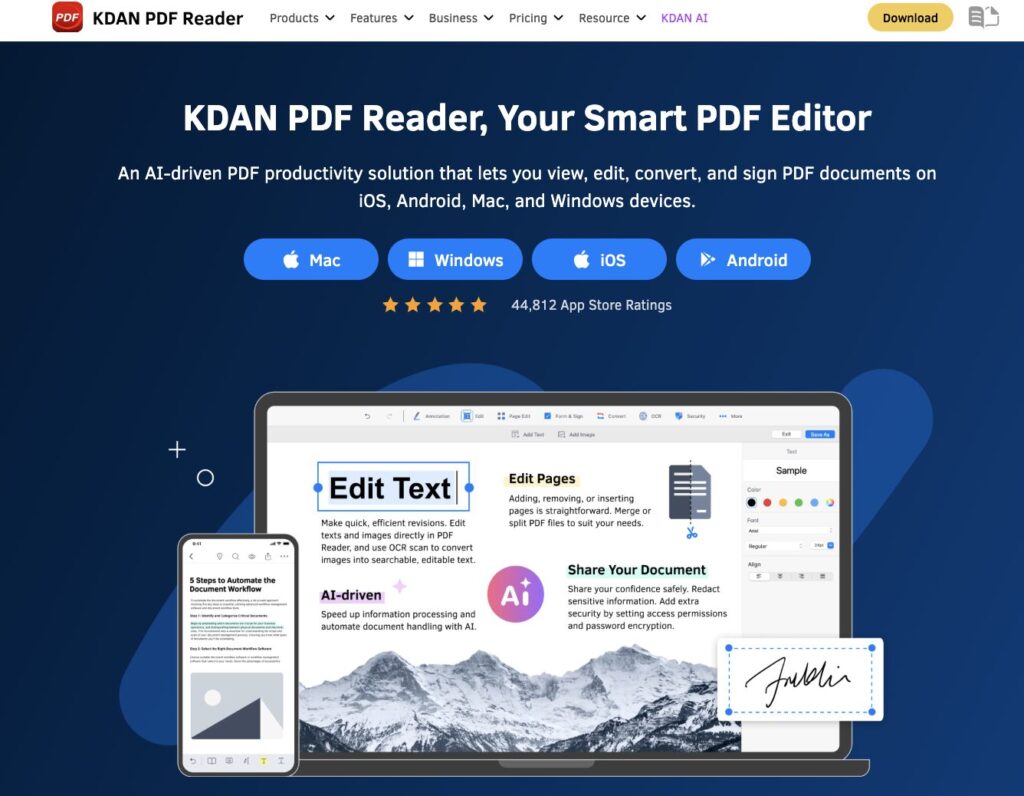

Filing tax forms can be stressful, especially when working with physical paperwork or unfamiliar tools. Digital solutions simplify the process by enabling users to fill out, sign, and manage tax documents efficiently from any device.

KDAN PDF Reader offers a streamlined, user-friendly platform for handling tax-related PDFs such as Form 4868. With built-in form-filling capabilities, secure digital signature options, and cross-device compatibility, KDAN provides a reliable solution for preparing and managing essential documents during tax season.

What is IRS Form 4868?

IRS Form 4868, officially titled the “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return”, allows taxpayers to request a six-month extension to file their federal income tax return. This form is commonly used by individuals who need more time to gather documents, organize finances, or complete their tax paperwork.

According to the IRS, to be eligible, the taxpayer must submit Form 4868 by the original tax filing deadline—typically April 15 of the filing year. For example, to extend your 2024 tax filing date, the form must be submitted by April 15, 2025.

Taxpayers use Form 4868 when:

- They are unable to gather all necessary documents by the tax filing deadline.

- Their tax situation is complex, or they need time to consult with a tax advisor.

- They are living abroad or serving in the military, which may qualify them for additional automatic time.

- They want to avoid the 5% per-month failure-to-file penalty by securing an extension to submit their return.

Why Use KDAN PDF Reader for Tax Forms?

Tax forms such as IRS Form 4868 require accuracy, security, and efficiency. Whether you’re requesting a filing extension or managing multiple financial documents, having the right PDF tool is essential. KDAN PDF Reader offers a streamlined experience that simplifies each step of the process—from filling out forms to securely signing and sharing them.

Read on to find out why KDAN PDF Reader is a strong choice for handling tax-related documents.

Download KDAN PDF Reader for free now!

Fill out and sign Form 4868 easily with KDAN PDF Reader—no printing, no hassle, and fully accessible across desktop and mobile devices.

Easy-to-use fillable PDF features

You can directly enter information into IRS forms without printing. The app supports interactive form fields, making it ideal for completing tax documents such as Form 4868.

Secure digital signature support

Instead of printing and manually signing, KDAN allows you to add a legally valid electronic signature. This is especially helpful when filing deadlines are tight or when submitting forms electronically.

Ability to annotate and export documents

Add notes, highlight instructions, or mark important deadlines directly within the document. Once finalized, export the PDF for printing, emailing, or archiving.

Mobile and desktop compatibility

Whether you’re working on your phone, tablet, or laptop, this cross-platform flexibility is useful for users managing documents on the go.

KDAN PDF Reader offers a practical and reliable solution for users who need to fill in, sign, and submit official forms efficiently—without paper or scanning.

Read More: Quick and Simple: How to Add a Signature to a PDF on Mac

Submitting Form 4868: Mail or e-File

Once you’ve filled and signed IRS Form 4868 using KDAN PDF Reader, the final step is to submit it. The IRS offers two primary methods: mailing a paper form or filing it electronically. Choosing the right method depends on your location, whether you’re making a payment, and your preferred level of convenience.

If you choose to file by mail:

- Print the completed PDF from KDAN PDF Reader. Ensure all information is legible and your signature is included if required.

- Mail the form to the correct IRS address, which depends on your state of residence and whether you are enclosing a payment. You can look up the correct mailing address using the instructions provided with Form 4868 (IRS mailing addresses by state).

- It’s recommended to use certified mail or a private delivery service to confirm timely delivery.

If you prefer to e-File:

- You can submit Form 4868 electronically using IRS Free File (for those meeting the income requirement) or through a commercial tax software provider.

- e-Filing is usually faster and provides confirmation when your form is received.

- If you’re using a tax preparer or an IRS-authorized e-File provider, they may need you to sign Form 8878 to authorize electronic submission on your behalf.

- To include a payment with your extension electronically, you can use IRS Direct Pay or pay by credit/debit card through an authorized processor.

Submitting your form on time is critical. While the extension gives you until October 15th to file your return, the IRS still expects any tax owed to be paid by the regular April deadline to avoid interest and penalties.

Checklist for a Smooth Submission

Before submitting Form 4868, it’s important to take a few extra steps to ensure your extension request is processed smoothly. Mistakes or oversights can lead to processing delays or unnecessary penalties—even if your intent was correct.

Here are some helpful tips to keep in mind:

- Double-check all fields: Make sure your name, Social Security Number (SSN), estimated tax amounts, and payment information are accurate and complete.

- Use the correct IRS mailing address: If you’re mailing the form, refer to the official Form 4868 instructions to find the correct address based on your state and whether you’re including a payment.

- Save a digital copy: Always keep a digital version of the completed and signed PDF for your records. KDAN PDF Reader makes it easy to export and store your form securely in the cloud or on your device.

- Pay any estimated tax due by the deadline: Filing Form 4868 only extends the time to file your return—not the time to pay. Submit any payments by April 15 (or the official tax deadline) to avoid late payment interest and penalties.

These small steps can help you avoid common issues and give you peace of mind as you prepare for the final return later in the year.

Next Steps for a Successful Tax Season

Handling tax documents like Form 4868 doesn’t have to be stressful or time-consuming. With KDAN PDF Reader, users gain access to a streamlined, reliable solution for downloading, filling, signing, and storing essential tax forms. The tool’s ease of use, combined with its cross-platform flexibility and secure features, makes it an ideal companion for anyone preparing a tax extension.

Whether you’re working from a desktop or on the go with a mobile device, KDAN PDF Reader offers the simplicity, accuracy, and convenience needed to complete and submit Form 4868 with confidence. By staying organized and using the right tools, taxpayers can meet deadlines and avoid unnecessary penalties—while keeping full control over their documents.

Submit Form 4868 on time with less stress.

Whether you’re filling, signing, or saving your tax extension form, KDAN PDF Reader offers the tools you need to complete it quickly and confidently—right when it matters most.

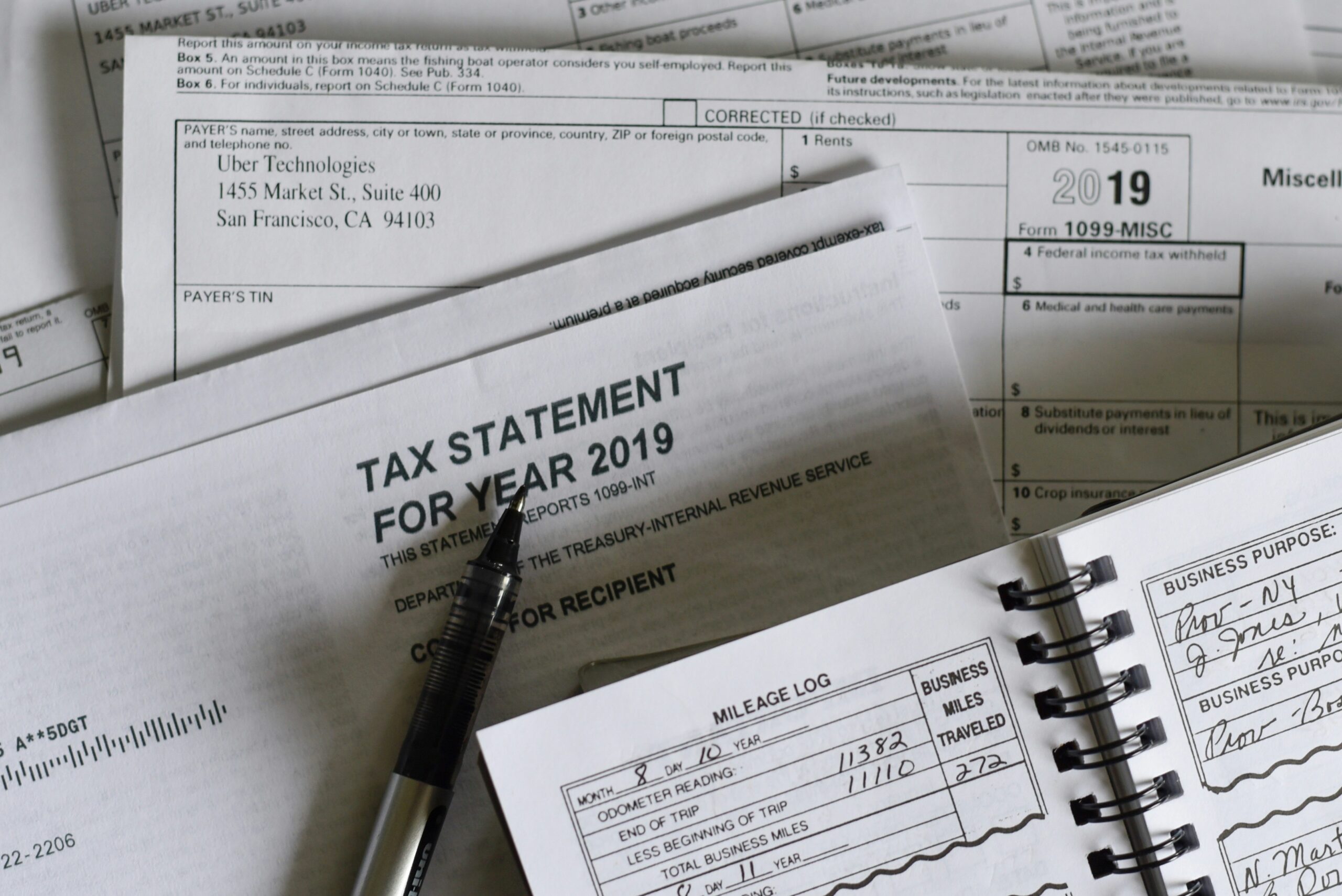

(The featured image is made by Olga DeLawrence on Unsplash)