5 Must-Know Tips: How to Fill Out a W-9 Form Step-by-Step

What is IRS Form W-9? How to fill out a w9 form?It’s a crucial document for anyone working outside the traditional employee structure, like freelancers, independent contractors, or self-employed individuals. If you’re providing services to a business, chances are they’ll ask you to fill out a W-9 form. This form helps the organization gather your taxpayer information, such as your name, address, and Taxpayer Identification Number (TIN), which they need to report payments made to you.

Who Needs to Fill Out a W-9 Form?

The W-9 form is typically required for independent contractors, freelancers, self-employed workers, and anyone providing services to a company but not classified as an employee. It may also be needed for reporting real estate transactions, mortgage or bank interest, debt cancellation, or student loan interest. If you fall into any of these categories, completing a W-9 form is essential for proper tax reporting.

When you’re hired for a project or provide ongoing services, businesses rely on the W-9 form to collect the necessary information to issue 1099 forms during tax season. This form is a critical step in ensuring both you and the hiring company stay compliant with federal tax regulations. Filling out a W-9 isn’t just about ticking boxes—it’s about getting paid accurately and keeping your tax obligations on track. To make the process effortless, here are 5 essential tips to help you complete your W-9 form quickly, correctly, and with confidence. Let’s get started!

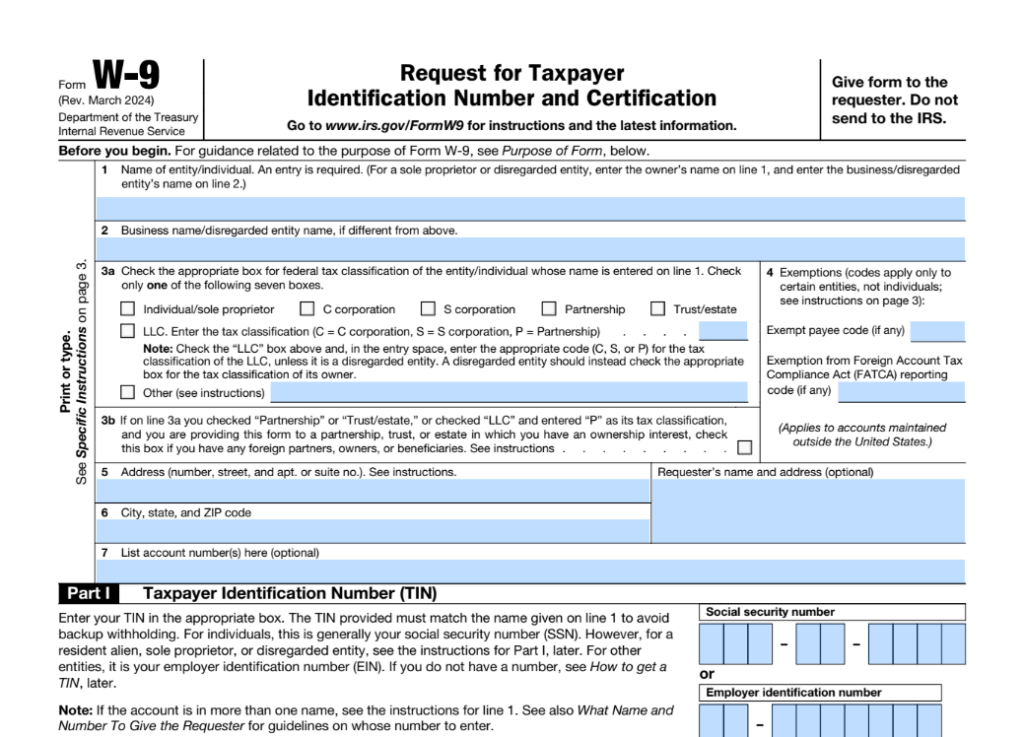

Step 1: Understanding the Form

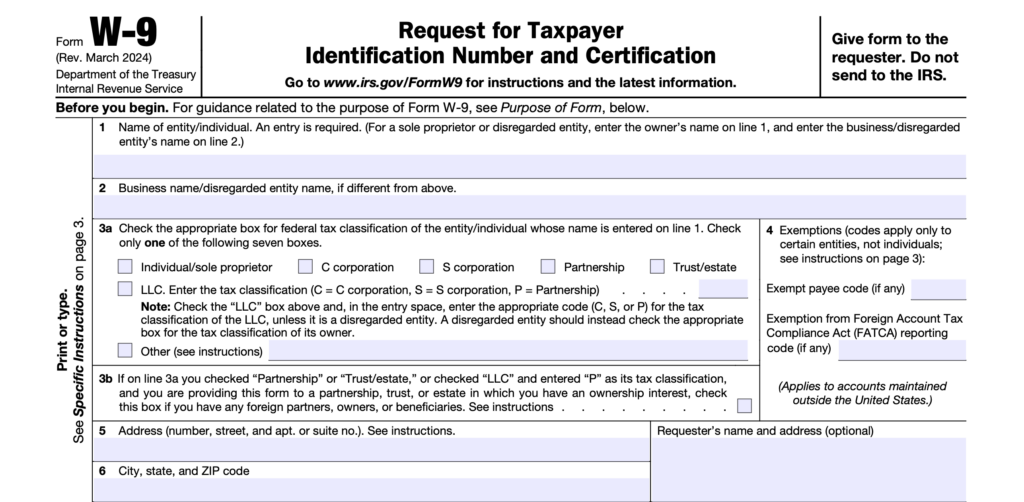

The W-9 form is divided into several key sections, each designed to collect specific information. At the top, you’ll need to provide your name, business name (if applicable), and federal tax classification, such as Individual/Sole Proprietor or LLC.

Below that, you’ll fill out your mailing address, ensuring it matches your tax records. You’ll also provide your Taxpayer Identification Number (TIN), which is either your Social Security Number (SSN) or Employer Identification Number (EIN).

The final section is the certification, where you’ll sign and date the form to confirm that the information you’ve provided is accurate and complete.

Accuracy is essential when filling out the W-9 form. Mistakes can lead to payment delays or errors in IRS reporting, so taking the time to carefully review each section is key to a smooth process.

Step 2: Filling Out the W-9 Form

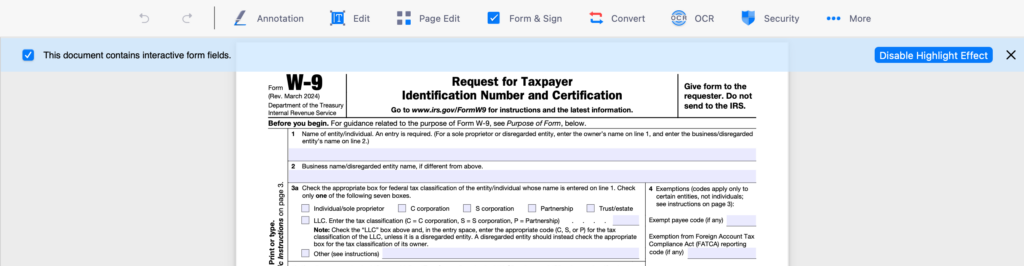

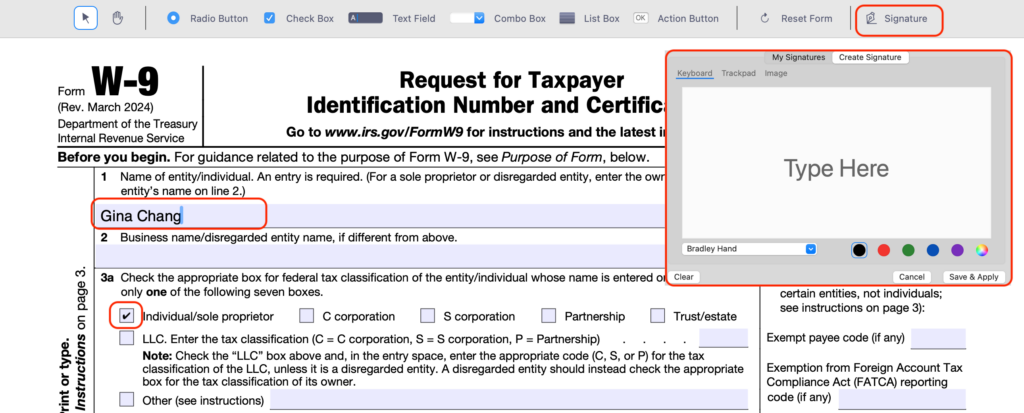

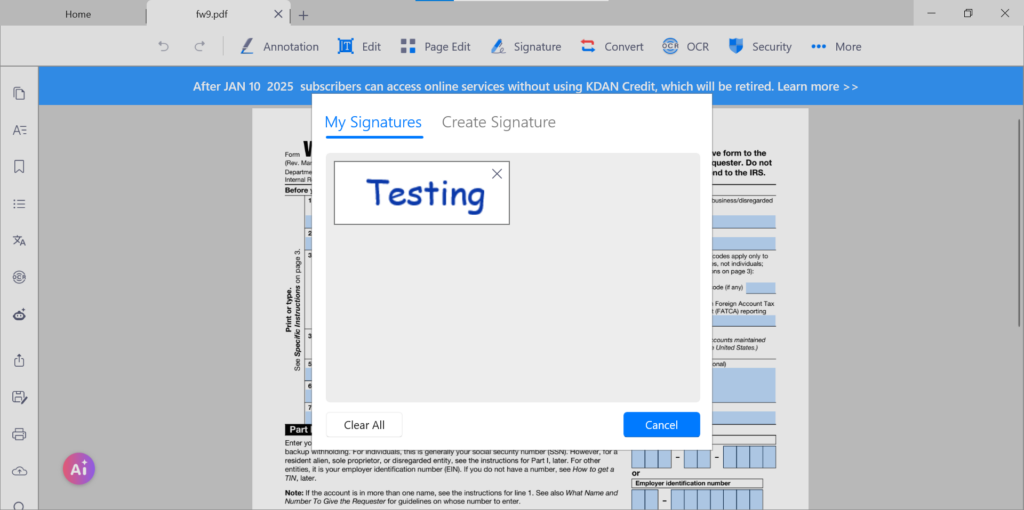

A W-9 form with a interactive features is designed to make filling it out straightforward by allowed you to type directly into text fields or select options as needed. With KDAN PDF Reader, completing the form is quick and hassle-free. Here’s a step-by-step guide to get it done effortlessly:

1. Open the W-9 Form: Launch KDAN PDF Reader and load the W-9 form (Downloaded W-9 form ).

2. Identify Fillable Fields: When the form opens, a message bar at the top of the screen will notify you if the PDF contains interactive fillable fields.

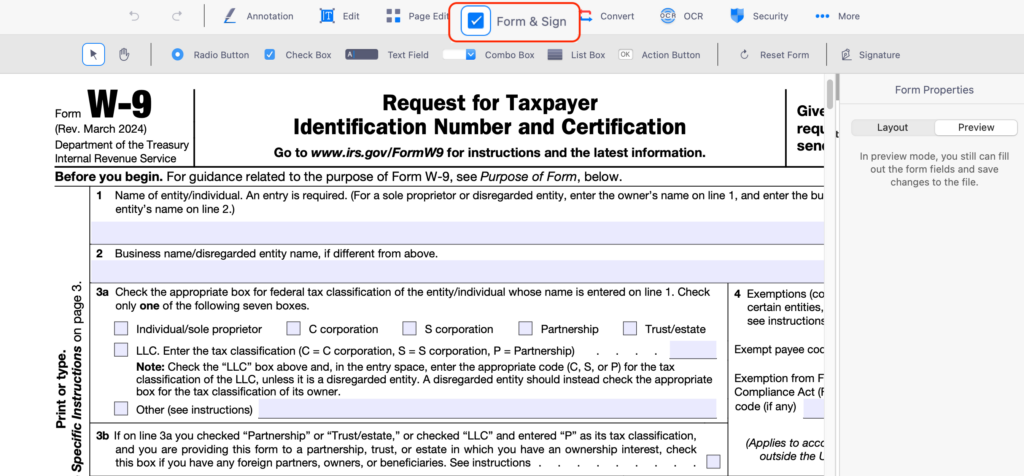

3. Highlight Fillable Fields: Click on “Highlight Form Fields” in the toolbar, and the PDF Reader will highlight all the interactive fields in the form, making them easy to locate.

4. Fill and Sign the Form: Use the “Form & Sign” option in the top toolbar to input your information and add your signature seamlessly.

5. Add Custom Fillable Fields: If needed, you can manually add additional fields for text, checkboxes, dates, or signatures to ensure all required details are included.

Step 3: Submitting the W-9 Form

Submitting your completed W-9 form can be done through physical delivery or electronic submission, depending on your preference and the company’s requirements. For physical delivery, print the form and hand it over in person or send it via mail, ensuring it is securely sealed to protect your sensitive information.

Alternatively, electronic submission offers a faster and more convenient option. Tools like DottedSign and KDAN PDF Reader make the process seamless by allowing you to fill, sign, and send the form digitally. These tools ensure security while streamlining the submission process, saving you time and effort. Always verify the recipient’s details before sending your form to maintain data confidentiality.

Filling out and submitting a W-9 form requires careful attention to accuracy and security to ensure a smooth process.

Step 4: Tips for Accuracy and Security

When completing and submitting your W-9 form, accuracy and security are key to ensuring a smooth process.

Double-Check Your Information

Before submitting your form, take a moment to review each detail carefully. Mistakes like misspelled names, incorrect addresses, or invalid Taxpayer Identification Numbers (TIN) can lead to IRS complications or delays in payments. A quick double-check now can save you from unnecessary hassles later.

Keep Your Information Safe

Since your W-9 form contains sensitive personal and financial details, prioritizing security is a must. Always use trusted and secure methods to submit the form, whether in person, by mail, or online. Avoid sharing your form with unverified sources or using insecure platforms to reduce the risk of data breaches or identity theft. And before sending it off, double-check that the recipient is legitimate to keep your information safe.

Step 5: Common Mistakes to Avoid

Filling out a W-9 form can sometimes lead to errors that cause delays or complications. However, using secure and reliable software like KDAN PDF Reader can help minimize these issues and make the process more convenient. Here are some common mistakes to watch out for:

- Missing or Inaccurate Information

- Double-check all fields for completeness and accuracy. Tools like KDAN PDF Reader highlight fillable sections, reducing the risk of leaving out essential details or making errors.

- Forgetting to Sign the Form

- Your signature certifies the accuracy of your information. KDAN PDF Reader simplifies this step by allowing you to add digital signatures quickly and securely, ensuring you don’t miss this critical requirement.

- Incorrect Tax Classification

- Selecting the wrong tax classification can create confusion. KDAN PDF Reader provides a clear layout of the form, helping you choose the correct box for your status, such as Individual/Sole Proprietor or LLC.

By using a secure tool like KDAN PDF Reader, you can streamline the process, reduce errors, and avoid the inconvenience of re-submitting your W-9 form.

# G2 2024 Best Office Software Award ⭐️ Download KDAN PDF Reader for Free! - Mac.Windows

FAQs: Everything You Need to Know About the W-9 Form

1. What happens if I make a mistake on a W-9 form?

If you make a mistake on a W-9 form, it can lead to incorrect tax reporting, payment delays, or IRS complications. To fix an error, complete a new W-9 form with the correct information and submit it to the requester as soon as possible. It’s always a good idea to double-check your details before submitting to avoid mistakes.

2. How do I know if I need to fill out a W-9 form?

You’ll need to fill out a W-9 form if you’re working as an independent contractor, freelancer, or self-employed professional providing services to a business. Additionally, businesses may request a W-9 for certain financial transactions, such as real estate deals, mortgage interest reporting, or student loan interest declarations. If in doubt, check with the organization requesting the form.

3. Is it safe to submit a W-9 form online?

Submitting a W-9 form online can be safe if you use secure platforms or trusted software like KDAN PDF Reader or DottedSign. These tools ensure encrypted communication and protect your sensitive data. Avoid sending W-9 forms via email unless the recipient has a secure email system. Always confirm the legitimacy of the requester and the platform before submitting your form digitally.

Master Your W-9 Form: Accurate, Secure, and Hassle-Free Filing

Filling out a W-9 form accurately and securely is essential for ensuring compliance with tax regulations and avoiding unnecessary delays or complications. By understanding the form’s requirements, double-checking your information, and using secure submission methods, you can complete this process with confidence.

To make the experience even smoother, consider leveraging tools like KDAN PDF Reader, which simplifies filling, signing, and submitting forms while ensuring your sensitive information remains protected. With the right approach and reliable tools, managing your W-9 form can be quick, efficient, and worry-free.

# G2 2024 Best Office Software Award ⭐️ Download KDAN PDF Reader for Free! - Mac.Windows

Connect with KDAN

Follow us to receive all latest updates and promotions.