Best Way to Organize Your W-9, W-4 and 1099 PDF Tax Forms

Whether you’re a freelancer, a salaried employee, or a small business owner, tax season can quickly become overwhelming if your essential documents aren’t properly organized. Among the most critical forms are the W-9, W-4, and 1099—each serving a unique purpose in income reporting and tax withholding. Unfortunately, many people face common issues such as misplaced files, missed submission deadlines, or incomplete records. These oversights can lead to delayed filings, penalties from the IRS, or even increased audit risks.

To avoid these pitfalls, it’s important to understand what each of these forms does:

- A W-9 is used by independent contractors and freelancers to provide their Taxpayer Identification Number (TIN) to clients.

- A W-4 is filled out by employees to let employers know how much federal income tax to withhold from their paychecks.

- A 1099 is issued by businesses to non-employees to report payments of $600 or more during the tax year.

Organizing these forms digitally—especially in PDF format—not only streamlines your tax filing process, but also protects your financial records in the long run. This guide will show you the best ways to manage, secure, and retrieve your W-9, W-4, and 1099 forms efficiently.

Understanding the Purpose of Each Form

Before organizing your tax documents, it’s important to understand what each form does and why it matters for your financial records. Here’s a quick breakdown of the W-9, W-4, and 1099 forms:

W-9 Form: Taxpayer Identification

The W-9 form is typically used by independent contractors, freelancers, and vendors. It provides your Taxpayer Identification Number (TIN)—usually your Social Security Number or Employer Identification Number—to a client or payer. This form doesn’t get submitted to the IRS directly but is used by the payer to generate a 1099 form at the end of the year.

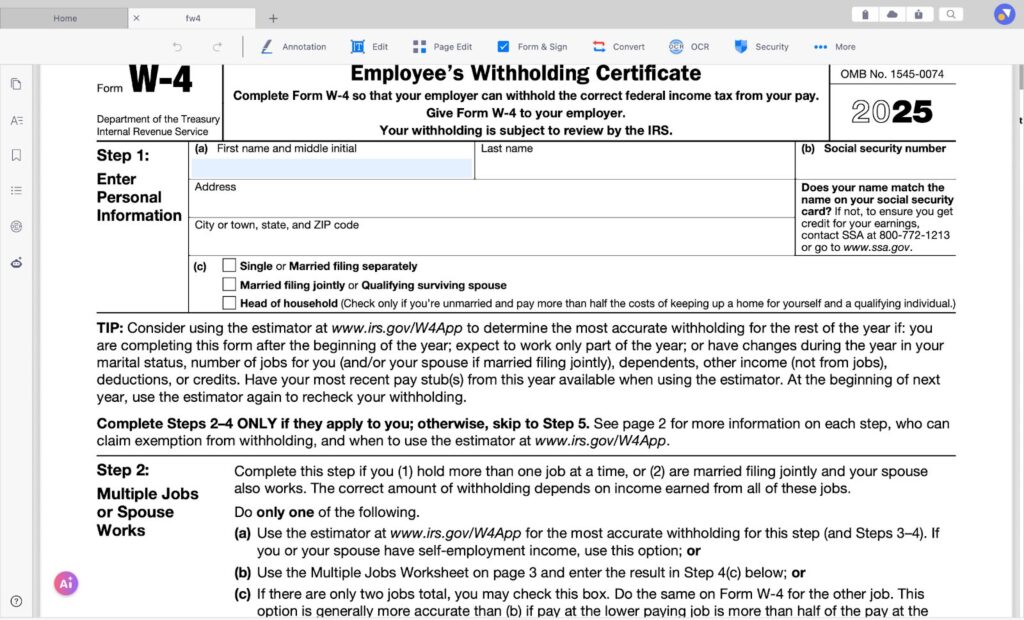

W-4 Form: Employee Withholding

The W-4 form is filled out by employees and submitted to their employer. It helps determine how much federal income tax should be withheld from each paycheck. Factors like marital status, dependents, and additional income affect the amount withheld. Submitting an accurate W-4 ensures you don’t owe too much—or get too little—when tax season comes around.

1099 Form: Income Reporting

The 1099 form is issued by businesses or clients to non-employees such as freelancers or contractors. It reports payments of $600 or more made during the year. You’ll need this form to accurately report your income to the IRS. There are several types of 1099s, but 1099-NEC (Nonemployee Compensation) is the most common for freelance work.

Understanding how these forms function is the first step to managing them effectively. In the next section, we’ll walk through how to organize them securely and efficiently for future access.

How to Set Up a Digital System for Managing W-9, W-4, and 1099 Forms

To manage tax-related documents effectively and securely, it’s essential to implement a consistent digital system. Below are key steps for organizing W-9, W-4, and 1099 forms using KDAN PDF Reader and widely available cloud storage tools.

Step 1: Create a Structured Folder System

Begin by building a clearly organized folder hierarchy on your computer or cloud drive. The recommended approach is to categorize files by both tax year and form type. For example, you might create subfolders like 2025/W-9, 2025/W-4, and 2025/1099. This method allows you to separate documents by their purpose and year of use, making it much easier to locate specific forms during tax season or financial reviews.

Step 2: Apply Consistent File Naming Conventions

Using a consistent and descriptive file naming format is critical for efficient document retrieval and version control. A recommended format is: FormType_Name_Year.pdf — for instance, W9_JohnSmith_2025.pdf or 1099_ClientABC_2024.pdf. Avoid using generic names such as Document1.pdf, which make search and identification difficult. Clear file names will also simplify communication when sharing files with accountants or legal professionals.

Step 3: Store Files on a Secure Cloud Platform

Once your folder system is in place, choose a reliable cloud storage solution such as Google Drive, Dropbox, or OneDrive. Storing documents in the cloud ensures they are accessible from multiple devices, provides version history, and protects against local hardware failures. If you need to share access with others (e.g., an accountant or business partner), be sure to adjust the sharing permissions to ensure only authorized individuals can view or edit the files.

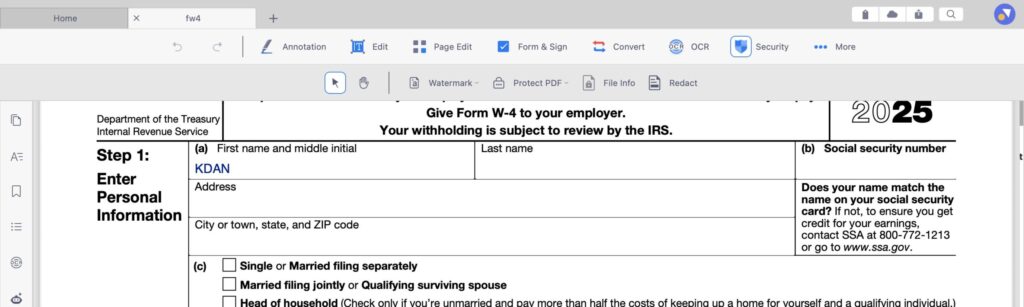

Step 4: Use KDAN PDF Reader to Fill and Sign Tax Forms

KDAN PDF Reader provides a complete toolkit for managing and editing PDF tax forms. You can open W-9, W-4, and 1099 forms directly in the application and input data into fillable fields without printing. KDAN also supports digital signatures, allowing you to sign forms electronically in a secure and legally recognized way. This functionality is especially valuable for remote workers or businesses that manage multiple contractor relationships.

Read more:How To Fill out a W-9 Form in Seconds?

Simplify your tax workflow.

Use KDAN PDF Reader to fill, sign, and organize your W-9, W-4, and 1099 forms with ease.

Step 5: Automate Repetitive Information Entry

If you frequently complete similar forms for multiple clients or employees, KDAN PDF Reader’s ability to reuse text and form fields can significantly improve efficiency. You can pre-fill commonly used information—such as your name, address, or tax ID—reducing errors and saving time across batches of documents. This is particularly beneficial for freelancers and HR teams handling standardized paperwork.

Step 6: Protect and Back Up Your Documents

Given the sensitivity of tax documents, it is crucial to ensure your files are properly secured. KDAN PDF Reader allows you to add passwords and encryption to your PDFs, helping prevent unauthorized access. In addition to storing documents in the cloud, maintain a secondary local backup—such as an encrypted external hard drive—so your data remains protected even in the event of a network issue or service outage.

Tips for Staying Organized Year-Round

Maintaining document organization should not be a once-a-year task. A proactive, year-round approach helps reduce last-minute stress and ensures that all necessary tax forms are ready when needed. Here are three practical strategies to help you stay organized throughout the year:

1. Set Calendar Reminders for Tax Deadlines and Form Updates

Tax deadlines and document submission dates can easily be overlooked, especially for freelancers or business owners managing multiple responsibilities. Use a digital calendar (e.g., Google Calendar or Outlook) to set recurring reminders for key events such as:

- Quarterly estimated tax payment deadlines

- Annual W-4 or W-9 updates

- When to expect 1099 forms from clients

This simple habit ensures that important tasks are not forgotten and allows time for any corrections if issues arise.

2. Regularly Archive Outdated Forms

At the end of each fiscal year, review your current folders and archive forms that are no longer actively needed. This reduces clutter and helps you focus only on relevant documents. Archived files should still be accessible—store them in labeled folders such as Archive/2023 or Prior_Years/W-9. This practice also reduces the risk of editing or sending outdated versions by mistake.

3. Create a Document Checklist for Each Tax Season

Having a checklist of required tax documents helps ensure that no form is missed during preparation. Your list might include:

- W-9 (for each contractor)

- W-4 (for new employees or updated withholding)

- 1099s received or issued

- Proof of income and expenses

Keep this checklist updated annually and refer to it each January to begin your preparations in an organized manner. You can store the checklist as a PDF within your tax folder or even integrate it into your cloud storage system for quick reference.

Build a Smarter System for a Stress-Free Tax Season

Properly organizing your W-9, W-4, and 1099 forms is more than just a clerical task—it’s a strategic approach that saves time, reduces errors, and ensures compliance with tax regulations. By creating a clear folder structure, naming files consistently, securing your documents, and using tools like KDAN PDF Reader for form completion and digital signatures, you can streamline your workflow and protect sensitive information.

Taking the time now to implement a reliable system means fewer headaches later. Whether you’re an employee, freelancer, or small business owner, setting up a digital organization process today will make future tax seasons more efficient, accurate, and stress-free.

Get Tax-Ready the Smart Way

Simplify your tax season with secure, organized W-9, W-4, and 1099 forms. Use KDAN PDF Reader to stay efficient and compliant—anytime, anywhere.

Connect with KDAN

Follow us to receive all latest updates and promotions.